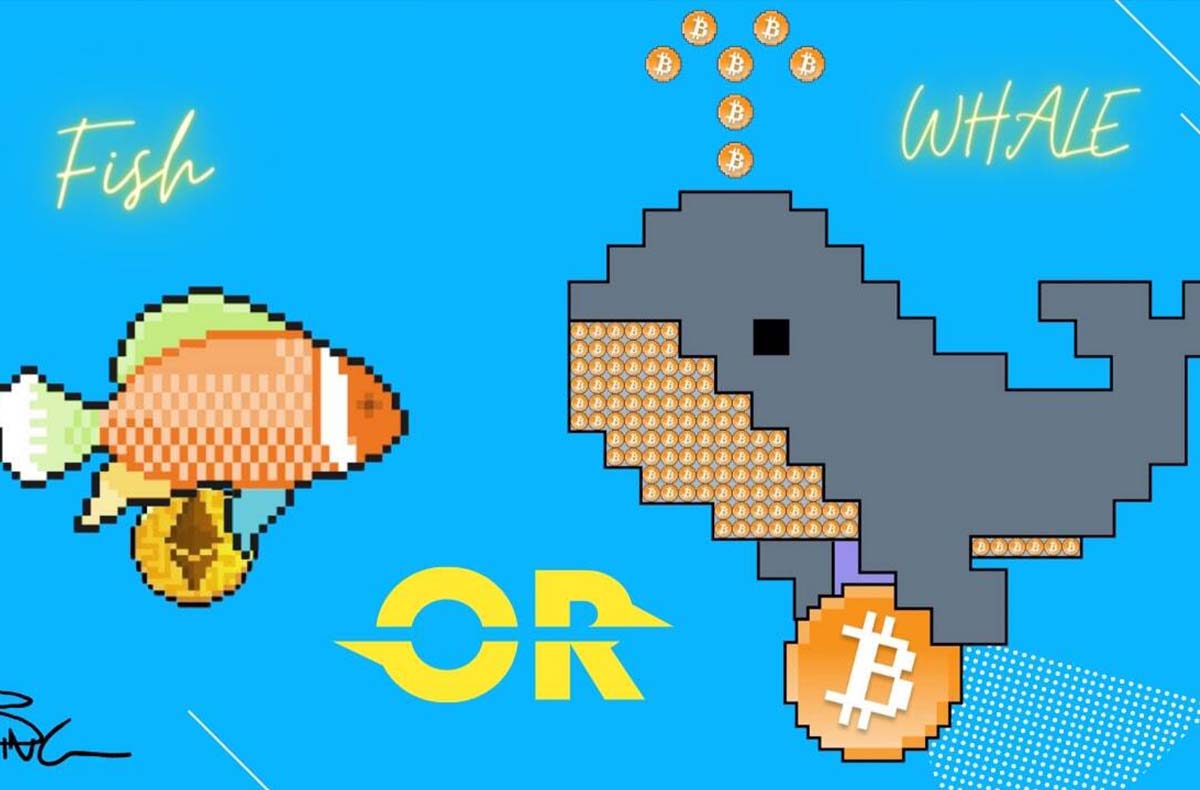

The nuclear “crypto winter” seems to be slowly melting away, but this thawing has yielded a noticeable change in the digital assets ecosystem, leading to a shift in the classification of some of those who were once considered to be the elite of the figurative crypto ocean.

The high stakes of the digital asset market have been revealed, with fortunes made and lost in the blink of an eye. Indeed, the swift transformation of the once-mighty “whales”—individuals who hold large sums of digital assets—into humble “fish” underscores the volatility of this emerging landscape.

As a seasoned observer of the crypto market, I have witnessed its ebbs and flows and recognize that the recent downturn has been particularly brutal, affecting both the value of digital assets and the portfolios of investors, leading to a bullish trend in this nascent ecosystem.

However, the past few months have seen a fiercely bearish market. A host of factors, including regulatory uncertainty, market manipulation and inflation, and the whims of large investors, drive the volatility.

Recent events, such as the FTX-SBF (Sam Bankman-Fried) debacle, the fall of Silicon Valley Bank (SVB), the Terra Luna crash and general turbulence in the digital assets marketplace, have caused a stir in this expansive community.

Although SVB had no direct link to FTX, it was not immune to the broader contagion. That said, the larger issues facing this ecosystem can be attributed to two main factors: inflation and a lack of regulatory clarity—both of which impact the value and stability of cryptocurrencies.

The decentralized nature of cryptocurrencies translates to no central authority governing their use and regulation, which has led to confusion and uncertainty among investors and stakeholders, particularly regarding taxation, security and compliance.

It has also made it difficult for institutions and institutional investors—who are often subjected to stringent regulatory requirements—to enter the crypto space, as it makes it challenging for them to assess the risks and benefits of investing in digital assets.

The lack of consensus among the largest three and four-letter government agencies in the United States is arguably the biggest contributor to the digital assets industry’s volatility. That is in addition to the need for a mutuality of definitions as to what cryptocurrency is, which has not been achieved yet.

This is the basis by which a coherent regulatory framework can be established. The FTX-SBF fiasco and the fall of SVB underscore the importance of regulatory compliance. It also highlights the need for transparency in the industry, which can help prevent market manipulation and reduce volatility. Because there is no single federal agency responsible for regulating cryptocurrencies, it is necessary for there to be a consensus among them.

Digital assets are regulated by a patchwork of agencies, including the Securities and Exchange Commission (SEC), the Commodity Futures Trading Commission (CFTC) and the Internal Revenue Service (IRS), among others. In addition to this, the level of regulation varies depending on the specific use cases of the cryptocurrency being used. With the digital currency market experiencing a drop of nearly $1.4 trillion in 2022 in the aftermath of a series of bankruptcies, corruption scandals, and liquidity issues, crypto seems to be heading for a rise again, which means the market cap for digital assets is seemingly limitless. As such, cryptocurrencies are experiencing a level of unprecedented attention and focus in their nascent history. But the issues remain.

Inflation, another leading reason for the state of the market, has affected many economies across the world. Most cryptocurrencies have built-in mechanisms to control inflation, such as Bitcoin’s halving events, yet it remains a concern for investors and stakeholders alike. In addition to inflation concerns, the importance of building relationships with traditional financial institutions is also crucial for the wider adoption and legitimacy of cryptocurrencies.

To gain acceptance and legitimacy, the crypto industry must work with banks and other financial institutions to create a more robust and resilient ecosystem. In the U.S. there is no single federal agency responsible for regulating cryptocurrencies, which is why there’s a massive need for consensus among them. America’s financial system is between a rock and a hard place. Because of the lack of regulatory clarity, institutions were not properly set up to be ready for black swan events such as this. If we had regulatory clarity, we would be in a much better situation than we are now. However, they are slowly figuring it out.

Despite the challenges, the allure of the crypto market persists, as it continues to captivate and confound even the most seasoned experts. The series of devastating recent economic events provide another unprecedented opportunity for new investors to attain whale status in the crypto ocean. Regaining trust in the digital assets marketplace should not be predicated upon the behaviors of bad actors such as those involved in the FTX debacle. However, it can be attributed to the need for regulatory clarity from the government and good governance structures throughout the banking industry. It’s important to remember that while the crypto market is still in its early stages, and there are still opportunities for growth and recovery in the future, there is a need for regulation that could protect investors and lead to more trust in the market.

In a volatile crypto ocean, the recategorization of some crypto whales as fish may be just a temporary reprieve. However, amid the tumultuous market conditions lies an unprecedented opportunity to forge a new class of whales. But until the disparate U.S. government agencies achieve consensus, this turbulence in the crypto waters will persist, and the looming specter of a catastrophic tsunami threatens to upend the fragile ecosystem. Will the industry sink or swim? The answer lies in the hands of regulators, investors and stakeholders.